Transfer and Conversion of shares

What is the tax implication on the gifting of shares or transfer of shares?

A gift can be received in the form of money or moveable property or immovable property without consideration or inadequate consideration. A gift exceeding the monetary value of ₹50,000 is taxable under the head of Income from Other Sources (IFOS), but the gift which is received from a relative or on the occasion of marriage, as inheritance or in contemplation of death is completely exempted from tax.

Shares and securities are moveable properties and you can gift stocks to friends and relatives online through CDSL easiest portal. See, How to gift stocks & securities to relatives using CDSL?

TAX IMPLICATION ON SENDER OF THE GIFT

After abolishing The Gift Tax Act in 1988, the sender need not pay any tax gift. However, under section 2(14) of The Income Tax Act, shares and securities are treated as Capital Assets and Sale of Capital Assets are taxable under the head of Income From Capital Gain. However, the definition of ‘transfer’ as per section 47 specifically excluded gifts. Therefore, the gift of shares and securities is not taxable in the hands of the sender of gifts.

TAX IMPLICATION ON RECEIVER OF THE GIFT

On transfer of shares and securities

• If the Fair Market Value (FMV) of shares and securities is up to ₹50,000, such gift is exempted from tax whether the receiver is relative or non-relative.

• If the Fair Market Value (FMV) of shares and securities is more than ₹50,000, such gift is taxed under the head of Income from Other Sources according to the slab rate if the receiver of the gift is a non-relative.

• If the shares and securities are received by a relative, then it is completely tax-free since a gift from a relative is exempted under section 56(2)(vii) of The Income Tax Act.

• If the shares and securities are received on the occasion of marriage or by inheritance or in contemplation of death of the payer, then it is completely tax-free whether the sender of the gift is relative or non-relative because such gifts are exempted under section 56(2)(vii) of The Income Tax Act.

On the sale of shares and securities

Income from the sale of gifted shares and securities is taxed under the head of Capital Gain. If the equity shares are held for more than 12 months from the date of purchase till the date of sale, it is termed as Long Term Capital Gain (LTCG). And If, the equity shares are held for less than 12 months from the date of purchase till the date of sale, it is termed as Short Term Capital Gain (STCG)

The holding period will be calculated from the date of purchase by the previous owner i.e. sender of the gift, till the date of sale by the receiver of the gift. Cost of acquisition will be the purchase price of the sender of the gift.

POINTS TO BE NOTED

• Both sender and receiver of the gift are advised to maintain proper documentation, such as a gift deed, to justify the genuineness of the transaction. This documentation will come in handy in case of scrutiny done by Income Tax department.

• The sender of the gift need not report the gift in the Income Tax Return. The receiver of the gift should report the gift under Schedule Exempt Income if the income is exempt or Schedule OS (IFOS) if the income is taxable. If the gift is taxable, calculate tax liability at slab rates.

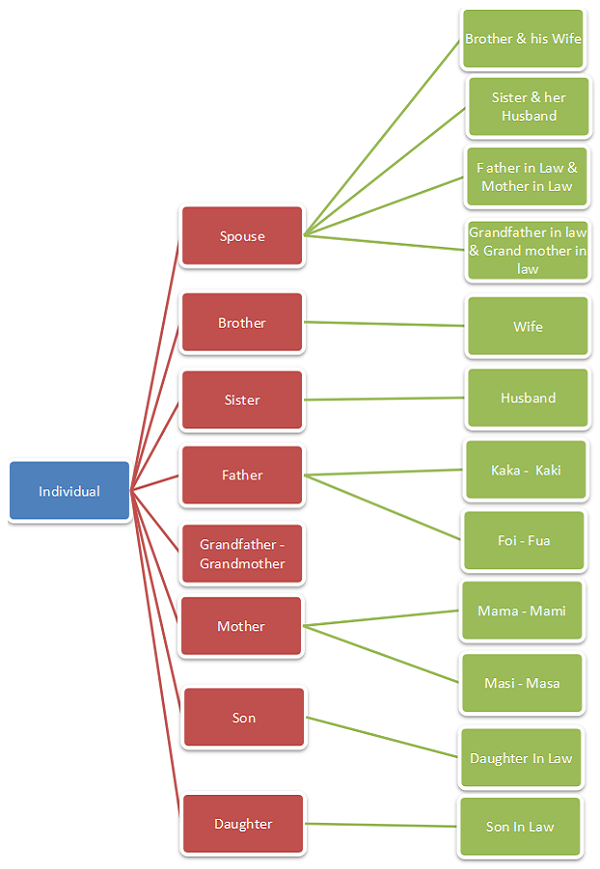

• Exhaustive List of Relative under Section 56(2):