Your Profile

What is Know Your Customer (KYC) and how can I check my KYC status?

"Know Your Customer" (KYC) refers to the process by which businesses verify the identity of their clients and assess their potential risks for money laundering or financing terrorism. The main objective of KYC is to prevent financial institutions from being used, intentionally or unintentionally, by criminal elements for money laundering activities.

KYC is necessary because it helps financial institutions comply with regulations, such as the Anti-Money Laundering (AML) laws and the Prevention of Money Laundering Act, 2002 (PMLA), that aim to prevent the abuse of the financial system for illegal activities. In India, SEBI has strict guidelines to comply with KYC while opening demat and trading accounts. By performing KYC checks, financial institutions can ensure that they are not doing business with individuals or entities involved in criminal activities, which helps protect the integrity of the financial system.

How to check KYC status?

To check the KYC status, follow the steps below:

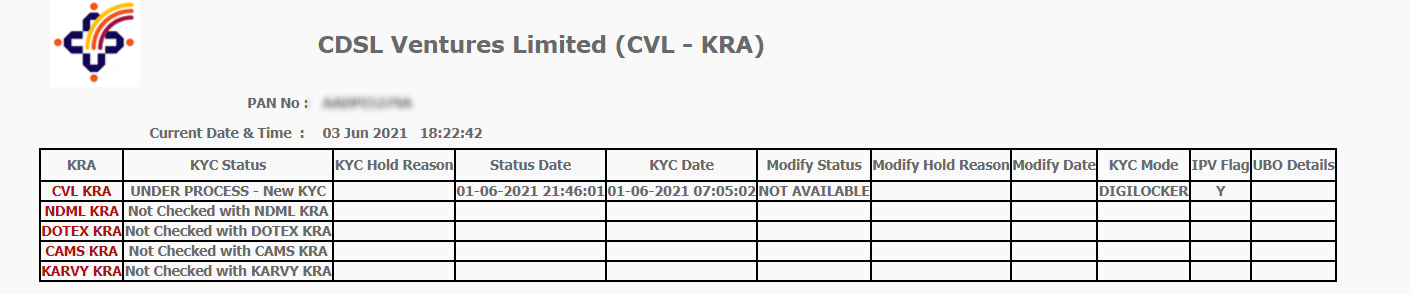

- visit https://www.cvlkra.com/

- Go to the KYC inquiry tab and enter PAN

- Enter the captcha and click on submit button.

What does KYC status mean?

If under the “KYC Status” column following things are mentioned:

Registered:Your KYC is registered successfully.

Under Process:This status shows up when you recently opened an account. It takes up to 5 days for KYC status to show up.

On hold or rejected: This status appears if the other brokers you have accounts with haven’t uploaded the KYC details correctly. If this were the case with ATS, we would send you an email regarding details about the documents required. See I have received mail from ATS asking for KYC information. What should I do?

Note:If your account has been inactive for a year or more, you have to update the KYC details again.